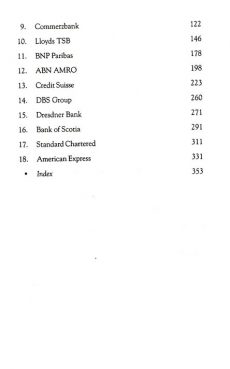

This book is about how Enterprise Risk Management (ERM) is evolving in the financial service industry. Key risk Management issues facing financial service firms include: Risk Governance, Regulatory and Economics Capital, Credit Risk Management, Market Risk and Asset/ Liability Management, Operational Risk Management, Risk Systems and Technology. ERM is being used by financial institutions seeking better decision- making, greater shareholder value, and stronger internal controls. ERM can simultaneously improve a company's financial performance, manage its risk profile and provide better risk disclosures to boards, shareholders, regulators, and rating agencies. It is not only external pressures (such as Sarbanes Oxley), which are giving an impetus to ERM, but also a growing realisation within companies that it can be uses as a tool for creating shareholder value. The growing seriousness of ERM initiatives is also helping to formalize the linkage between a company's business operations and its overall risk management program. The first part of the book covers conceptual issues. The second illustrates these concept, using case studies on well known financial institutions such as, Lehman Brothers, Royal Bank of Canada, ING Group, Comerzbank, Lloyds TSB, BNP Paribas, ABN AMRO, Credit Suisse, Dbs Group, Dresdner Bank, Bank of Scotia, Standard Charted and American Express. It is hoped that book will be very useful to studies, academics and bankers, wanting to know more about ERM.

Enterprise Risk Management in Financial Services Industry

In stock

Free & Quick Delivery Worldwide

reviews

Bibliographic information

Title

Enterprise Risk Management in Financial Services Industry

Author

Edition

1st ed.

Publisher

ISBN

9788131404355

Length

xii+363p., Figures; Tables; Bibliography; Index; 23cm.

Subjects

There are no reviews yet.